Digital Trade

Exchange of Digital Assets, Liabilities and Equity Value

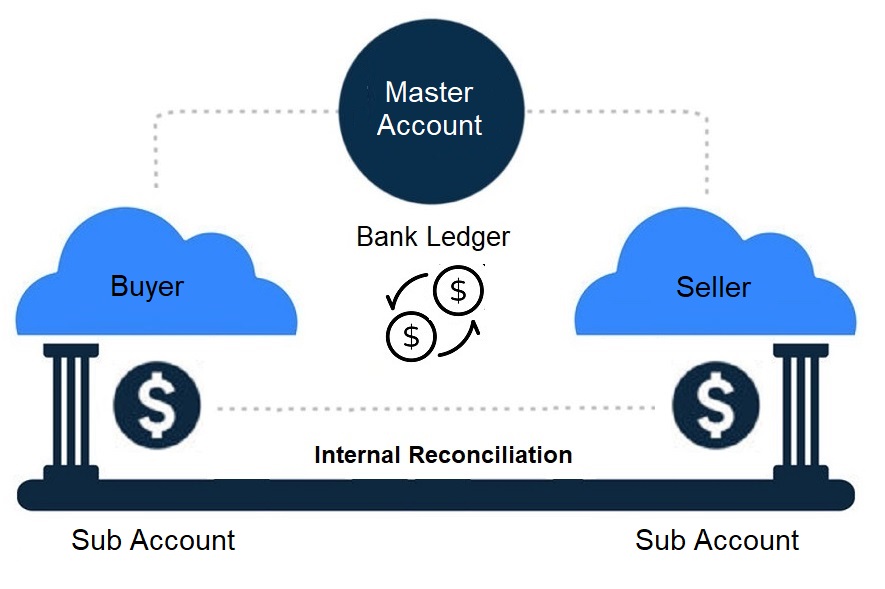

Direct Bank to Bank Technology

Global credit transfer between Treasury Banking data processing and banking partners with or without standard clearing intermediaries.

ISO20022 Messaging

Data Import & Export

Instant SQL connectivity | Direct integrate | Easy Reconciliation

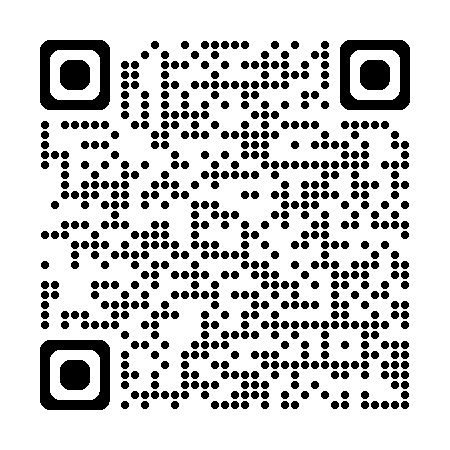

QRC Transfers

Treasury Bank utilize QR code with ISO 20022 messaging as its Application Programming Interfaces (APIs).

Tokenized Barcode and QR code

Tokenization enables a more secured and direct debit transfer from members accounts via rest API mapping, with barcode or QRC printing with Magnetic Ink Character Recognition MICR. Codes are Imprinted on Digital Cash Letter and sent to banking partners via wholesale lockbox to felicitate an EFT.

Closed looped transfers for more secure and efficient reconciliation

Treasury Bank transfers digital payment certificates with source of proof as an Authorized Push Payment and credit transfer; Transfers are done directly between ledgers. This includes using Barcode or QR codes MICR with ISO 20022 XML or JSON API from account to account or bank to bank.

Digital – Treasury Bank send funds to members payment bank or cards to spent digitally.

Fiat – Treasury Bank exchange nations currencies between members third-party external global bank accounts.

All transfers includes:

- Push payments methods: Credit as a grantor sending payments

- Pull payments methods: Debit payment as buyer payment

Card Transfer

Treasury Bank transfers funds from stored value card account with sources of proof and balance transfer via MICR or API, reference to internal treasury funds.

- Treasury Bank transfers are digital “High or Low “Value; unsecured or secured.

- It comes with a favorable periodic interest rates as dividends for payment agent and processors.

- They are transferred by Treasury Bank Independently for its members only to pay supply chain and work force expenses.

- Cards are private label credit cards that may or may not be associated with a major card network like Visa or MasterCard.

User case

• Direct closed network for treasury bank treasurers

• Direct Transaction

• Design and issue card with treasury bank brand

• Can only be accepted and used with Treasury Bank’s members

• Treasury Bank and it members must processor payment with Treasury Bank and the same acquiring bank

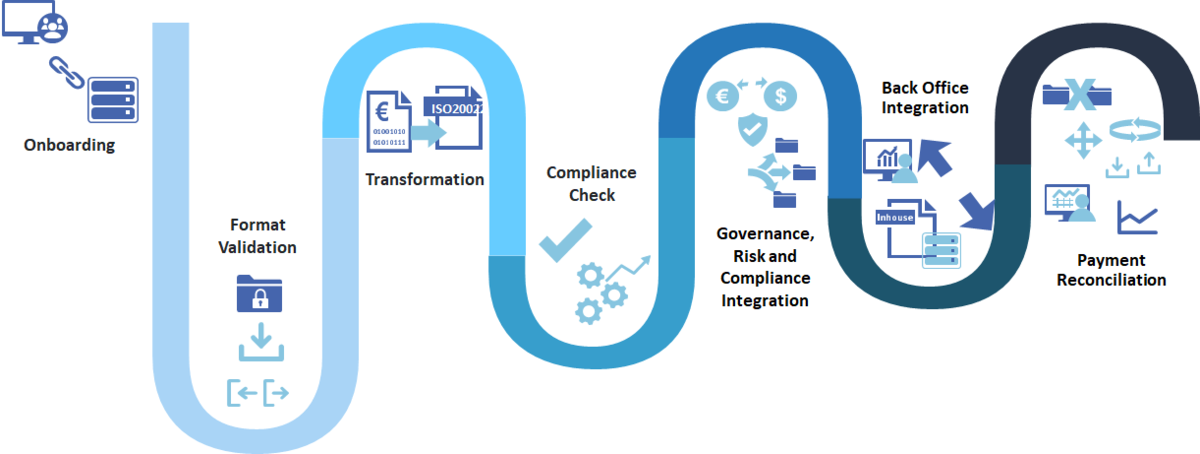

Integration Tools

Treasury Bank leverages it third-party back-office API integration with Treasury Bank core network via B2B or direct connect utilizing XML or API import and export setting with ISO 20022 or 8583 data messaging.

Electronic Payroll

- Our digital asset payables are straight through digital exchanges.

- Transactions are automatically paid as business investment expenses.

- Funds are distributed through an international payment network using XML and Rest API combinations.

How Does it Work

- Step 1. Treasury Bank members securities are underwritten and stored as a treasury account receivables via open bank XML or JSON API and then book transfer to members payable cash account at treasury bank.

- Step 2 Funds are cleared with back office Compliance as a Service CaaS and held at Treasury Bank Portal as a digital grant voucher in parallel with storage card or QRC account.

- Step 3 Member instruct and authorize Treasury Bank to transfer data virtually, from cards magnetic tape, or chip as credit or debit transactions.

- Step 4 Treasury Bank issue a command with data processor via QR code using XML and Application Programming Interfaces (APIs) for virtual or physical transfers for members.

Transfer and Reporting

- Making funds transfer decisions and orders

- Automatic email notification of file creation -interface to SMTP servers

- Export Reports to Excel, Word, or PDF

- Full online and transparent audit trails

Clearing as a Service CaaS

CaaS is managed by HSC Clearing Corporation. It handles risk management, due diligence, Investment compliance, chief finance services and fiduciary duty.

- Risk Management & Due Diligence

- Investment Compliance

- Chief Financial & Fiduciary Service

Transfer Overview

Treasury Bank generally separates its transfers into high and low value streams:

- High value transfer (inter-payments)

- Low value transfer (external retail payments).

High value transfer are settled instantly H2H P2P, B2B. Low value payments are batched and settled generally via ACH at end of day or 1 to 3 days.