Chief Treasurer

Chief Treasurer

How Does a Bond Grant Work

A Bond Grant is a multi level bonds combination to ensure that project owners and stakeholders are protected during the CIP construction process. Understanding Bond Grant Agreement Bond Grant agreements are pledged from general contractors for construction projects to receive a grant to pay contractors expenses. It is obligation pledge that guarantee contract fulfillment. The … Read more

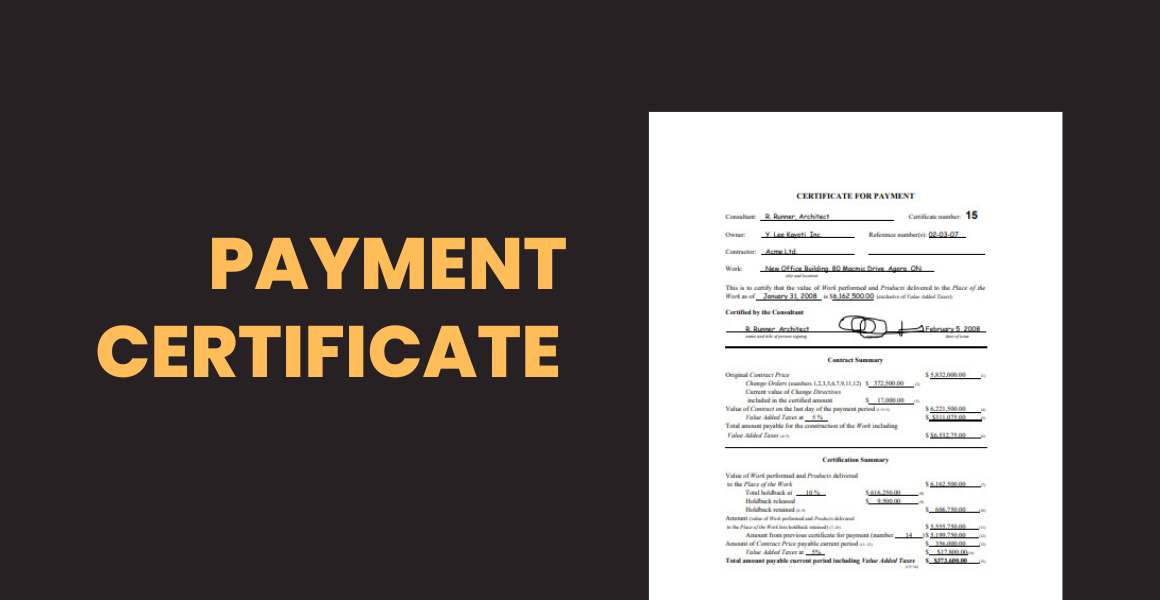

Payment Certificates

Payment certificates are the standard for Treasury Bank’s payments processing for accountholders within a Community Investment Program CIP. They have a major impact on cash flow and are issued over the lifespan of a CIP. It’s important that Accountholders have a good understanding of how payment certificates work. In this article, I will outline the … Read more

Why is Investment Products Not Insured by the FDIC

TBO offering accountholders a broad array of investment products that are not traditional deposit accounts. But unlike traditional checking or savings accounts, non-deposit investment products are not insured by the FDIC, even if they were purchased from an FDIC-insured bank. This guide will help you identify non-deposit investment products that are not FDIC-insured. What Products … Read more

High and Low Value Payment

Overview Treasury Banks generally separate its payment into high and low value streams: High value payments are settled instantly H2H P2P, B2B. Low value payments are batched and settled generally at end of day or 1 to 3 days. High Value Payment Systems (HVPS) HVPS transfer large value inter-bank transactions. Transactions settle in real-time and … Read more

Clearing Account

A Treasury Bank clearing account is a third-party pass-through master account that held and managed by the Hill Scott Corporation HSC a Louisiana Clearing Corporation with a commercial Clearing Bank. The clearing account is used as an external zero balance commercial bank product. It is the initial receiver of high value private funds. Private funds … Read more

CIP vs Investor Relationships

Community Investment Program CIP is an issuer and legal entity that develops, registers and sells securities to finance its operations. CIPs may be corporations, investment trust or domestic or foreign governments. CIPs are legally responsible for the obligations of its Investments and for reporting financial conditions, material developments and any other operational activities as required … Read more

10 Key Benefits of Treasury Bank’s XML Settlement for Investments

1. XML Settlement Are Used Globally The key benefit here is that once you have developed a community investment program with Treasury Bank and submitted your Money Market Account information and supporting Bank payment format then you have done the bulk of the hard work. For example, once you have created your banks compliant payment … Read more

Understand T2B Integration

Treasury Bank Organization is a private closed held Boutique Investment Bank. We use a common type of H2H connection through a Secure File Transfer Protocol (SFTP) with IP whitelisting. This type of transaction is also known as a ‘bank-to-bank’ or H2H payment. Host-to-host connectivity removes this friction by providing a direct connection between our members and … Read more