Data Banking

Digital assets, liabilities and equities titles are held with maximum security: AML, KYC, CDD, EDD and OFAC clearing methods

How Does It Work

1. Contracting

Agreement, planning, development, and underwriting

2. Storage

Securities deposit regulatory compliances, due diligence.

3. Trade

Buy, Sell, Exchange, Transfer, Transmit, or Cash Out

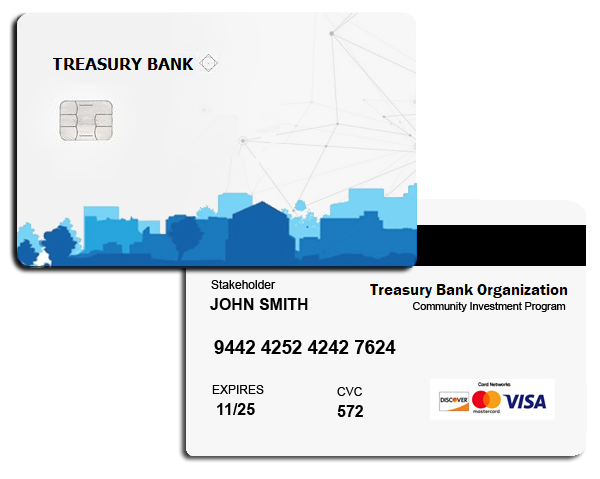

Tokenized Stored Value Cards

for Physical or Virtual Credit and Debit

Virtual Account

Treasury Bank cards hold internal tokenized source of proof and value. Stored digitally & directly, on a internal accounts or external cards. Cards are used for storage until transferred internally or externally via data processing.

Benefits

- “High” or “Low” Value and unsecured or secured

- Favorable storage fees or periodic interest rates for processors.

- Issued independently to pay supply chain and work force expenses.

limitations

- Direct “closed” network

- Direct Transaction

- Issued by treasury bank brand

- Can only be accepted and used by Treasury Bank’s trading partners.

- Can only be stored with the same network

Integration Tools

Treasury Bank leverages it’s third-party back-office API integration with data processors and trading banks core network via B2B or direct H2H utilizing XML or API import and export setting with ISO 8583 or 20022 data messaging.

Protection & Management

Offers intangible and tangible asset protection and certification with membership incentives.

Dematerialization

Imported documents are dematerialize and programmed as electronic smart contracts that control digital asset coinage and tokenization value as digital instruments and currency.

Distributed Ledger Technology DLT

DLT is preformed through the Treasury Bank Portal that is externally link with third party networks using ISO 20022 XML API connection for real time receivables and payables with secure protocols, in relation to Treasury Bank ISO Checklist and Priorities to certify the following document types.

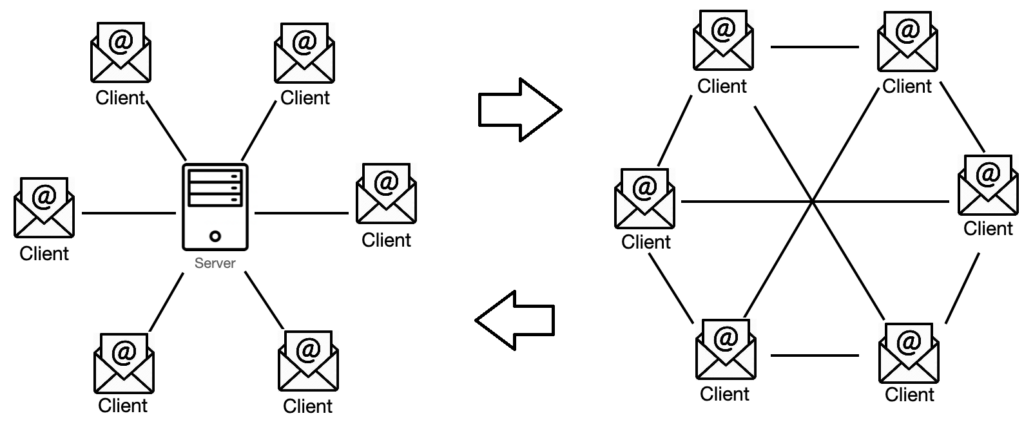

Autonomous Consensus Mechanism

Secure Gmail Chain

Treasury Bank internal autonomous Trade Districts chain is utilized email Interoperability with its secure third-party Gmail network for its centralized and decentralized consensus. Cc and Bcc assumes the role of tacit collections timestamp proof, forwarding, and settlement to reconcile orders between member email data exchanges.

Cc transparency and BCC private forwarding with enhance email security:

- Do a Security Checkup to make members account more secure.

- Update your software to protect against spam, phishing, and malware.

- Use unique, strong passwords and enable two-factor authentication (2FA).

- Remove apps and browser extensions you don’t need.

- Message is encryption using Gmail’s Message Security encryption features

Stakeholder Benefits

Benefits include:

- Improved compliance Better KCY by procurement credit checks

- Improved efficiency and privacy – straight-through transmission which void unnecessary intermediaries that compromise data

- Better data consistency – minimize human error and data breaches.

- Centralized financial management better procurement, invoicing and cash management.

- More accurate cash flow forecasting – more accurate cash flow forecasts.

- Faster Payments – payments in real-time P2P B2B outside of standard 1 to 10 days Swift, TCH, Federal Reserve, and ACH

- Minimizing Systemic Risk – less data intuition, fraud, and internal or external bad actors.

- Members CDD and EDD Clearing – Jurisdictional pre-screening for OFAC regulation support.

Minimizing Systematic Risk

Treasury Bank digital asset custody adheres to but is not limited to the Credit Card Accountability Responsibility and Disclosure Act of 2009. It is also in line with Payment Card Industry Security Standards Council PCISS compliances; FFIEC/FinCen/BSA Travel Rules, internal and external KYC, and OFAC

Treasury Bank provides the following multi-level private non-solicited investment settlement for members that allows:

- Non-Consumer commercial transactions

- Member privacy

- Financial inclusion

- Internal control

- Minimize risk

- Minimize Regulation

- Multiple accounts at the same or different banks

Security Measures

- Bank level SFTP SSH or API connection

- Collect card data using customizable forms you can embed into your application

- Secure card data in a PCI Level 1 compliant and SOC2 certified environment

- Use tokens to send and receive card data or tokens with payment processors or endpoint

- Login Challenge Screen (Password Protected)

- Automated Backups

Validation

Digital Assets are validated by:

- Members consensus

- Recipient acceptance

- Real Asset Certification

- CPA audit

- Member identification

- Verified Source of Proof

- Securities Registration statement (local, state and federal SEC and FTC travel rules) or exemption.

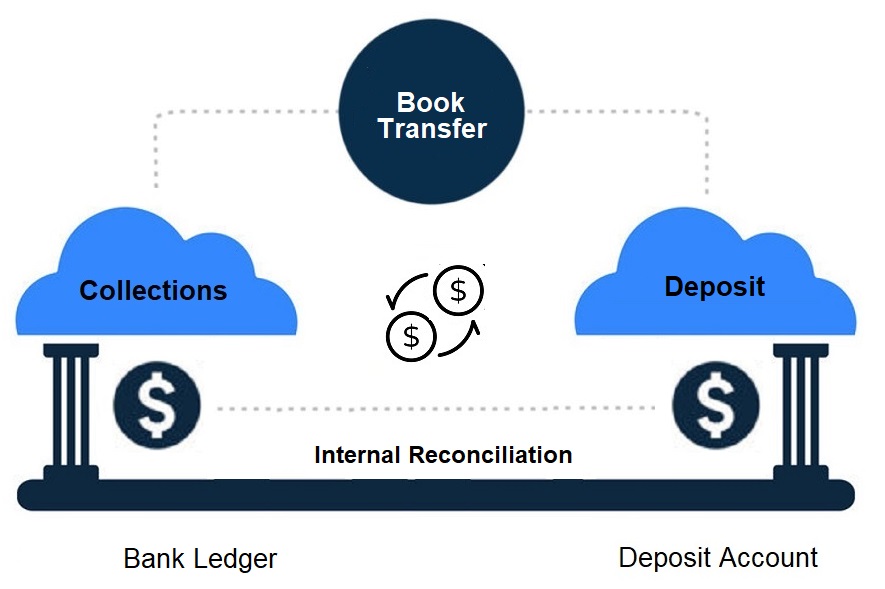

Fiat Deposit Control

Treasury Bank Administrator issues a Depository Account Control Agreement DACA that serves to perfect a security interest in fiat within a money market deposit accounts.

Deposit Account

Treasury Bank’s administrator forms a tri-party agreement between master and sub accounts to utilizing a parallel settlement between fiat clearing and settlement within the same bank with the following services:

- Opening Bank Account

- Cash Management

- Reconciliation and Audits