Payment certificates are the standard for Treasury Bank’s payments processing for accountholders within a Community Investment Program CIP. They have a major impact on cash flow and are issued over the lifespan of a CIP. It’s important that Accountholders have a good understanding of how payment certificates work. In this article, I will outline the different types of payment certificates, why they’re important, as well as how to make one.

The Different Kinds of Payment Certificates

Payment certificates can vary depending on the accountholder, investor, and project. Here are some common types.

- Interim Certificates These certificates are issued at throughout the lifespan of a project and are payments from an Administrator to a Accountholder.

- Certificate of Practical Completion. This certificate is issued when the practical components of a CIP are completed based on what was agreed upon in the original contract.

- Certificate of Non-Completion is a formal notice issued to contractors when a project cannot be completed by the deadline in the contract. This certificate signifies that the contractors have failed to meet the requirements of the contract.

- Final Certificate. This is only submitted once all the project deliverables are completed with all accounts fully settled, and signifies the end of the contract.

These certificates are common to most construction projects so it’s important to be familiar with them. They represent a formal account of the work that is completed and are verified by the contractors, clients, architects, and more. More than importantly, these contracts will usually include an interim payment from the client.

Each project is unique. How Accountholder or a contractor approaches their payment certificates will vary from person to person. That’s why both parties should work together at the start of the project to decide on progress and payment milestones. This reduces unnecessary delays and ensures that both parties can focus on the project at hand. Now, let’s talk about what an invoice looks like.

Understanding the Invoice

As mentioned, interim certificates are issued throughout a CIP and are supporting documentation for the invoice. Accountholder will submit an invoice, and the Administrator will review it to ensure that the invoice is representative of the actual work that has been completed. Assuming that it is satisfactory, the Administrator will approve the invoice and begin processing payment.

To begin, a Accountholder will issue an invoice to the Administrator. This invoice will clearly several things, including:

- The time period for which it is applying for

- The value of the work that has been completed during this period

- The amount of tax that must be paid for this period

- The total amount that must be paid during this period

- And finally, an updated Schedule of Values that represents this time period. A schedule of values is a detailed list of every task that must be completed. Each item is listed alongside a price and a record of completion for every time.

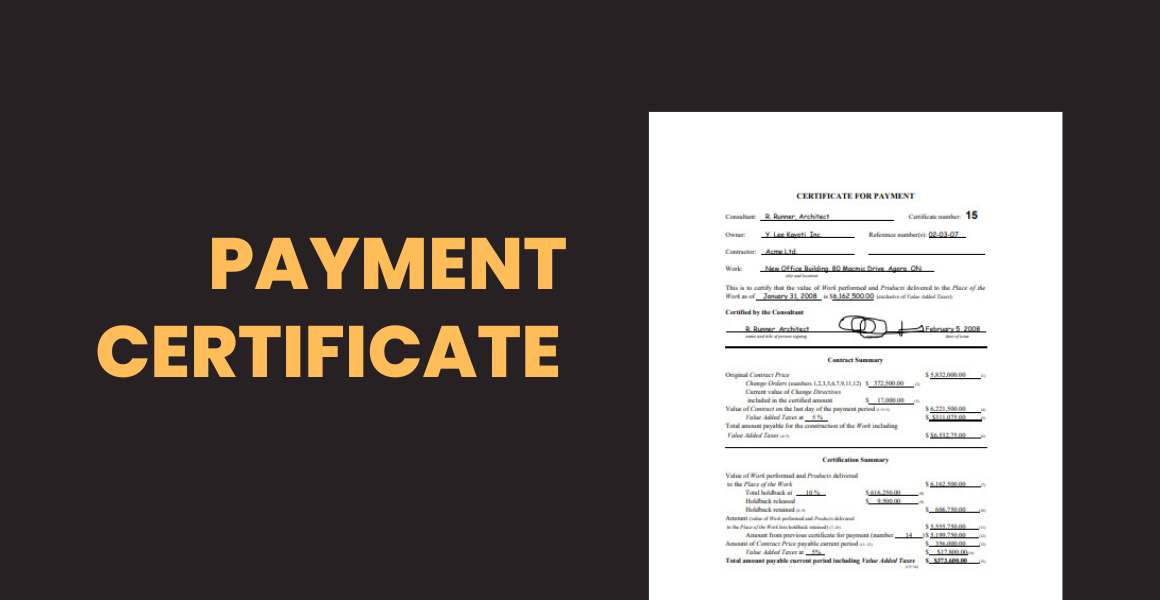

To help you visualize an invoice, we’ve included a sample for you to look at below.

Understanding the structure of a Payment Certificate

After Administrators have received the invoice, the Administrator will review it and perform a review of the project with the team’s developers. Afterwards, the Administrator will issue a payment certificate as long as the invoice is accurate.

This payment certificate will include several important elements, such as:

- Original contract value

- Approved change orders

- Present contract value (which includes any changes that have been made to the project)

- The value of work performed during the period the contractor is applying for

- Any changes to the value of work (including taxes, holdback, and previous amounts)

- The total payable amount for this period

Similarly, we’ve included an example of a payment certificate below.

Payment Certificates at Contractor Complete

At this point, you should have a solid understanding of what an invoice looks like, as well as what a payment certificate looks like. While issuing a payment certificate is relatively straightforward, the process can get repetitive and time-consuming very quickly. That’s why we recommend that you consult with an Administrator to get a better overall solution to Treasury Bank Portal. Our digital services will help you manage your projects with ease. Further, Treasury Bank Portal allows you to store the document digitally, thus reducing the need to store a physical copy. Above all, our process reduces inefficiencies and ensures that all parties have a clear understanding at all stages of a project.